We are quickly approaching the period of time in which we typically apply PGRs. Unfortunately, May was not kind and June has been dry. Many are struggling with figuring out when to start PGR applications and how aggressive we should be with that first application. In this blog, I link to our most recent Cotton Specialists’ Corner podcast on this very issue. This episode highlights several things to keep in mind before we run a stiff rate of PGR to an already stressed plant and potentially hurt yields.

Recent Updates

2022 UT Soybean Scout Schools

UT’s Soybean Scout Schools will be held in July (see details below). These field-side programs cover the basics of soybean growth, scouting, pest identification, and general management. Pesticide recertification and CCA CEU points will be available. Scout Schools are offered free of charge with sponsorship from the Tennessee Soybean Promotion Board. Registration is not required. Participants will receive a scouting notebook and a sweep net while supplies last.

West TN – Madison County, July 11th, 9:00 AM – 11:30 AM. This school will be at the West TN Research and Education Center, 605 Airways Blvd. Jackson TN, 38301. Signs will be up at the station to direct you to the field.

West TN – Henry County, July 12th, 9:00 AM – 11:30 AM. This school will be at Norwood Farms, 645 Norwood Rd, Mansfield, TN.

Middle TN – Lincoln County, July 13th, 9:30 AM – Noon. This school will be at H&R Agri-Power, 11 Highland Rim Road, Fayetteville, TN 37334. Lunch will be provided courtesy of H&R Agri-Power. A head count is required for the meal, please contact Bruce Steelman of the UT Lincoln County Extension Office at (office) 931-433-1582 or (cell) 615-542-1364 if you plan to attend.

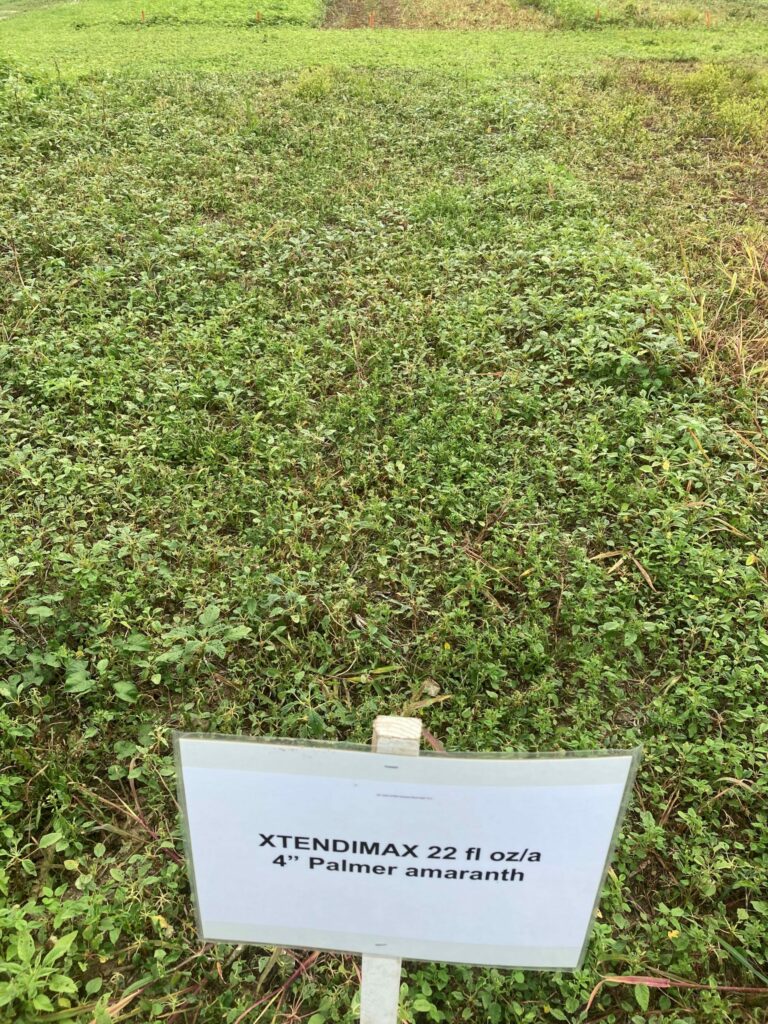

Auxin Herbicide Resistant Palmer amaranth Management

Getting reports from several consultants frustrated with the lack of Palmer amaranth control after applications of either Dicamba or Enlist One in cotton and soybean. Indeed, in our second year of field research at locations where dicamba or 2,4-D provided sketchy pigweed control in 2021 we are seeing similar if not worse Palmer amaranth control in 2022 (Picture 1). Continue reading

Junglerice and Barnyardgrass Management in Soybean and Cotton

There have been several reports last week of multiple glyphosate and/or clethodim applications not controlling barnyardgrass or junglerice. We really do not know the precise reasons for the lack of control in any given field but based on previous research and past experience there are a couple likely causes. Continue reading

Entries Accepted for 2022 UT Top Bean Yield Contest

The Tennessee Top Bean soybean yield contest sponsored by the TN Soybean Promotion board and coordinated by UT Extension is open for entries now until September 2nd for the 2022 season. Continue reading

Is it time to irrigate corn?

Corn is not sensitive to water limitations in early vegetative stages, but it’s important to watch the growth stages and soil type when timing irrigation. After V8, corn undergoes rapid vegetative growth and ear size determination begins (Table 1). A corn plant’s irrigation requirement will drastically change with the onset of hot and dry conditions such as are being experienced this month (Figure 1). Continue reading

Threecornered Alfalfa Hoppers in Vegetative Soybeans

I’ve received several phone calls over the past few days about threecornered alfafa hoppers in V-stage beans. Many of the questions are related to the recent cotton injury that was observed in West TN where cotton was planted behind a legume cover crop. Hopper injury in beans is not the same as hopper injury in cotton. Hopper injury in seedling (less than 6 nodes) cotton often results in a girdle on the main stem. Over time the girdle swells, the cotton stops growing, the leaves turn red and the cotton dies.

Hopper injury in beans results in a girdled main stem, when plants are less than 8-10 inches tall, that doesn’t result in plant death like cotton. Girdled beans are at increased risk for lodging late season when neighboring plants don’t have time to compensate. Yields of girdled plants won’t be affected unless they break over during the season. Hopper damaged beans tend to be worse in thin stands and poorly growing soybeans. Hoppers are typically easy to control with pyrethroids or acephate. Insecticide seed treatments provide some protection against hoppers during the seedling stage, although levels of protection can be highly dependent on environmental conditions. For more information on thresholds and control options please visit: https://guide.utcrops.com/soybean/soybean-insect-guide/threecornered-alfalfa-hopper/

UT Weed Tour is this Wednesday June 15

JACKSON, Tenn. – The University of Tennessee Institute of Agriculture will host the annual Weed Tour is this Wednesday, June 15 at the West Tennessee AgResearch and Education Center. The guided tour will feature 40 weed management research tests in corn, soybean and cotton as well as a demonstration of herbicide symptomology. Continue reading

JACKSON, Tenn. – The University of Tennessee Institute of Agriculture will host the annual Weed Tour is this Wednesday, June 15 at the West Tennessee AgResearch and Education Center. The guided tour will feature 40 weed management research tests in corn, soybean and cotton as well as a demonstration of herbicide symptomology. Continue reading