By Nutifafa Adotey, Assistant Professor & Soil and Nutr. Magt Specialist, Forbes R Walker, Professor & Envt. Soil Specialist, and Frank Yin, Professor & Cropping System Scientist, University of Tennessee

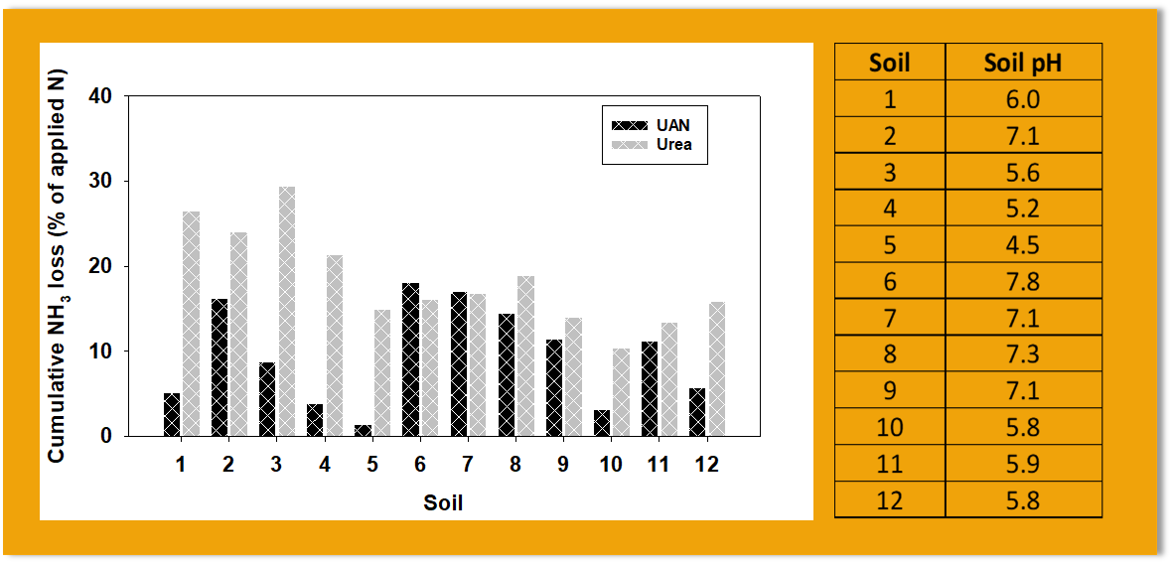

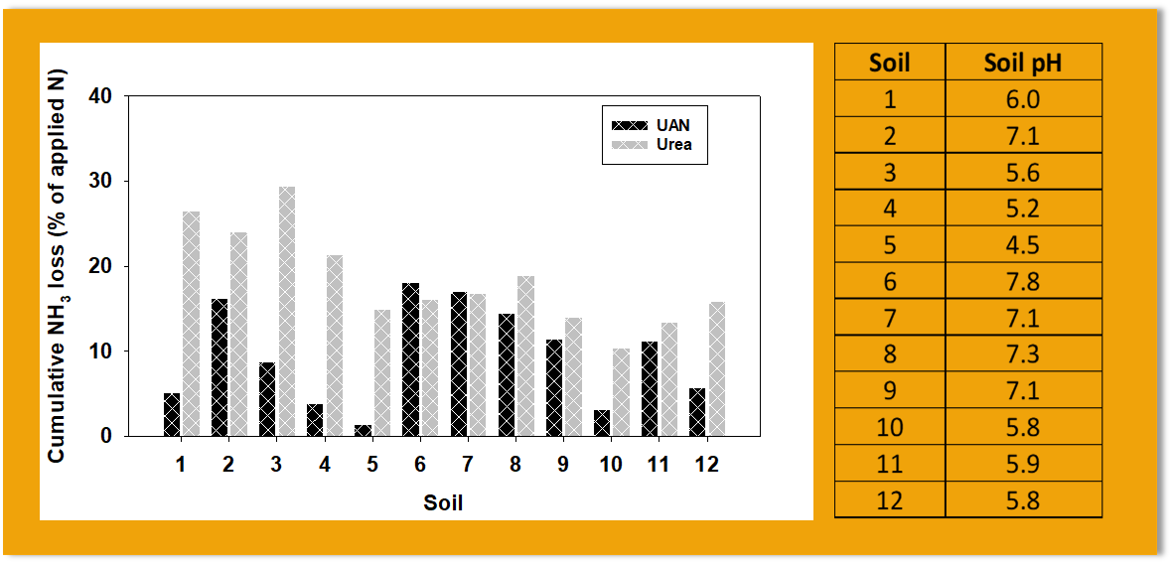

In Tennessee, the primary N fertilizer sources used are urea and urea ammonium nitrate (UAN). Other sources of N fertilizers, such as anhydrous ammonia, are used in some counties in Central and West Tennessee. It is a known fact that ammonia volatilization from applied N fertilizers may occurs from (1) unincorporated, surface-applied urea-based fertilizer; (2) anhydrous ammonia due to poor equipment calibration; and (3) unincorporated, surface-applied ammonium-based fertilizer on alkaline soils. This N loss from these fertilizers is governed by a complex interaction of prevailing environmental conditions, soil properties and management practices. Soil properties determine the potential of ammonia loss while the extent of the loss is dictated by environmental conditions and management practices. Continue reading →