Visitors to the Milan No-Till Field Day can hear presentations on research involving corn, cotton and soybeans. Due to growing interest in cover crops, two tours (10 total presentations) will be devoted to that topic. New this year – a tour devoted to managing resistance, a tour on fragipans, and a producer-led panel discussing personal experiences with precision agriculture technology. Continue reading

Category Archives: Farm Management

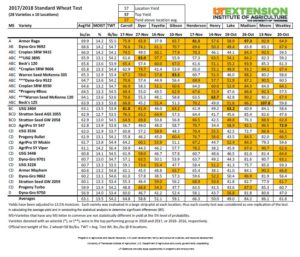

2017/2018 County Standard Wheat Trials

2018 County Standardized Trials (CST) wheat harvest data are now available. Our county trial yields were consistent with yields in much of the state, down around 15 bu from what we had last year. Late planting due to excess moisture and a cool, wet spring with delayed fertilizer and insecticide applications, didn’t get this crop set up for record year.

Herbicide injured cotton: Deciding to keep it and management after

I’ve received several calls this week requesting information on whether or not to keep injured cotton and management after the injury. In this brief article, I will cover the ‘keep or discard’ decision and briefly cover best management practices after the decision to keep the crop has been made. Depending on your situation, you may need to document the injury and/or keep a portion of the field to determine the yield penalty. That information is beyond the scope of this article but should be available from your insurance agent or attorney. Continue reading

UT Extension Commodity Market Update

Corn: September futures were down $0.03 today. For the week, corn has declined $0.13. The decline was primarily caused by the enactment of a 25% tariff on $50 billion worth of Chinese imports. Going forward, weather should dictate market prices as the crop year progresses. Planting progress for continues to march forward with 92% of the crop having been planted as of 5/27/2018 with 72% having already emerged. The current crop rating is 79% good-to-excellent. Locally, new crop basis for corn averaged -$0.08 as of today’s market close.

West Tennessee Grain Bids can be viewed here: West Tennessee Grain Bids 6-1-2018

UT Extension Commodity Market Update

Corn: Since the beginning of May, September corn futures have traded in a sideways pattern. The mid-day price of $4.14 for the September contract is only two cents higher than the closing price of $4.12, which occurred on May 1st. The sideways pattern can be attributed to a few things. We have experienced some delays in parts of the Midwest. However, as of May 20, we have already planted 80% of the crop, which is in line with the 5-year average. We have also yet to hit volatile stages of the growing season when weather dictates the market price direction. These factors combined with a not-so upsetting WASDE report this month has resulted in the market not swinging wildly in either direction. New crop corn basis is averaging -$0.09 as of today. Continue reading

UT Commodity Market Update – 5/4/2018

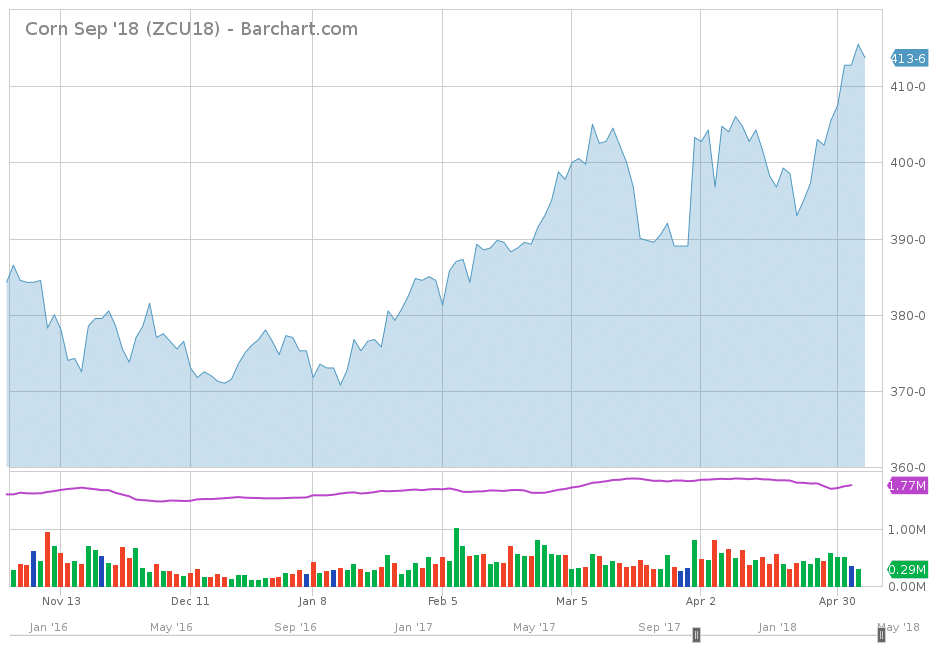

Corn: Since the beginning of the year, the September futures contract has increased by $0.40. An interesting fact is that of this increase, $0.21 has occurred over the last two weeks. The below chart reflects the recent run-up in corn futures:

Looking at the above the chart, obviously, something is driving the market. This begs the question as to what is causing the uptick in prices. Most of the nation’s corn crop is planted in April and by mid-May. Continue reading

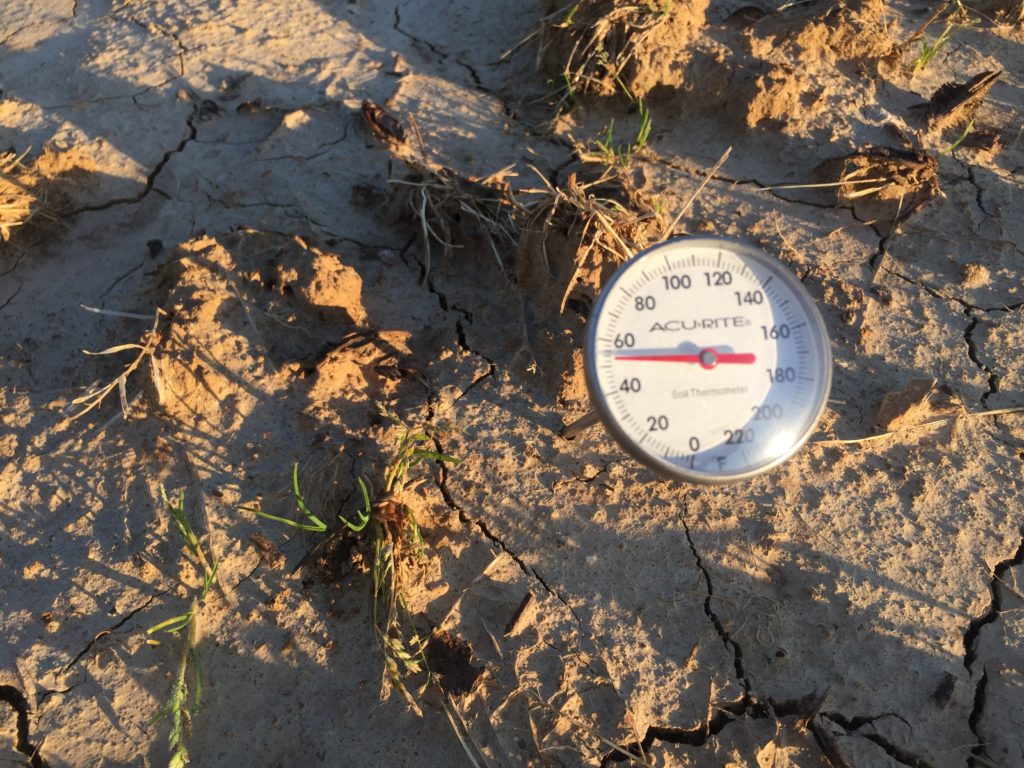

Easing off the clutch: 2018 cotton planting

I’ve visited with several over the past few days who either started planting yesterday (4/30), who plan to begin today (5/1), or who will be planting by tomorrow (5/2). While we have a few very early planting-date trials established here in Jackson, none of our large-plot trials have been planted and none of our small-plot work requiring normal planting dates have been planted either. That will change for my program today (5/1). Continue reading

I’ve visited with several over the past few days who either started planting yesterday (4/30), who plan to begin today (5/1), or who will be planting by tomorrow (5/2). While we have a few very early planting-date trials established here in Jackson, none of our large-plot trials have been planted and none of our small-plot work requiring normal planting dates have been planted either. That will change for my program today (5/1). Continue reading

UT Commodity Market Update 2/19/2018

Corn: Last week, March corn futures closed $0.03 cents higher while September corn futures closed $0.03 higher as well. The spike higher in soybean prices is continuing to pull the other grains along with it. However, in part, the latest USDA’s World Agricultural Supply and Demand Estimate (WASDE) indicated that corn exports will continue to improve, which will cause a reduction in ending stocks. Continue reading