The MonthlyCropOutlook011222 is a summary of the USDA’s monthly World Agricultural Supply and Demand Estimates (WASDE) report. This summary is prepared monthly by Dr. Aaron Smith. In the report, domestic balance sheets for corn, soybeans, cotton, and wheat are displayed. Market reactions for each commodity on the day of the report release are also reported. Additionally, supply and demand estimates for key importing and exporting countries are provided for the current month along with change in estimates from the previous month’s report. The profitability outlook has also been updated after the release of January 2022 USDA WASDE report.

Category Archives: Farm Management

Tennessee Market Highlights – 01/07/2022

Corn, soybeans, and cotton were up; wheat was down for the week.

2022 brings drastically different prices than one year ago for many row crops. At the start of

January, December corn closed at $5.47 ½, up 26% compared to last year; November soybeans closed at $12.83 ¾, up 14.5% compared to last year; December cotton closed at 92.95, up 23.3% compared to last year; and July wheat closed at $7.55, up 20% compared to last year. High commodity prices are positive for farmers; however, input prices and availability continue to challenge producers planning the 2022 crop. Fertilizer prices are double or triple last year’s prices and availability of crop protection products are providing planning issues and creating headaches for producers and ag retailers alike. Even if high prices hold, producer profitability is projected to be lower than 2021. Continue reading at Tennessee Market Highlights.

Tennessee Market Highlights-12/17/2021

Corn and soybeans were mixed; cotton was up; and wheat was down for the week.

Corn export sales this week were very strong helping to propel the March futures price to close on December 16th at $5.90 ¼. Corn weekly export sales were a marketing year high of 76.7 million bushels for the week. Given current export commitments, as a percent of USDA

estimated marketing year total exports, of 61% compared to the five-year average of 53%, it is very likely that USDA will need to raise corn exports from the current estimate of 2.5 billion bushels. Last marketing year the US exported 2.753 billion bushels. Based on the current pace, the 2021/22 marketing year could be greater than the previous year. Should this marketing year’s exports exceed last year’s, the March contract could challenge the contract high of $6.40 ½ set on May 7, 2021. For now, the first major hurdle is for corn to break above the $6.00 level for the nearby futures contract. Continue reading at Tennessee Market Highlights.

Tennessee Master Farm Manager Program

For producers needing to satisfy TAEP certification requirements, the Tennessee Master Farm Manager is a new educational Extension program. This program meets the requirements for maximum cost-share for Application A, B, or C. Master Farm Manager will focus on solid business principles and efficiently utilizing resources on the farm. The in-person Tennessee Master Farm Manager program will be offered on January 13th and 14th, at the Tennessee Tractor, LLC in Martin, TN. For more program and registration information, please follow the link to Tennessee Master Farm Manager.

Tennessee Market Highlights – 12/10/2021

Corn was mixed; cotton and soybeans were up; and wheat was down for the week.

There is more risk this year, than typical years, for producers between now and when projected (spring) crop insurance prices are set. Many producers use crop insurance as the base for their risk management program. However, a concern for producers is the approximately three months between now and the end of the crop insurance price determination period (February 28 in Tennessee), during which producers will have no price protection unless they use market-based risk management strategies. Commodity prices have been strong but are showing signs of weakness or at the very least hesitancy before any potential upward move. Additionally, input prices have doubled or tripled compared to last year. Producers that are purchasing inputs before the year end, without pricing or setting a price floor on some of their anticipated 2022 production, have a tremendous amount of financial risk. As such, producers may want to consider mitigating some of the financial risk by establishing a price or price floor for some 2022 production. Continue reading at Tennessee Market Highlights.

Tennessee Market Highlights

Corn and wheat were up; cotton and soybeans were down for the week.

Prices were mixed this shortened trading week. Friday saw a post-Thanksgiving Day sell off in stock markets that bled over into commodities. The DJIA shed 898 points on Friday due to fears of a new COVID-19 variant. December cotton dropped 3.78 cents, January soybeans were down 13 ¾ cents, and December wheat was down 11 ¼ cents. December corn closed up 7 cents for the day but had a wide trading range ($5.66 ¾ to $5.88; 21 ¼ cents). Next week will determine if this is a short term over reaction or if follow through selling occurs in stock markets and commodity futures. Continue reading at Tennessee Market Highlights.

Early season tobacco tips

Authored by Mitchell Richmond and Zachariah Hansen Now that everyone is washing their tobacco setters [transplanters] to be garaged until next year, it is a great time to think about some of the crop management decisions for the upcoming field season. These decisions may include solutions for pest control in your tobacco crop. Continue reading

Now that everyone is washing their tobacco setters [transplanters] to be garaged until next year, it is a great time to think about some of the crop management decisions for the upcoming field season. These decisions may include solutions for pest control in your tobacco crop. Continue reading

Research and education-Two surveys

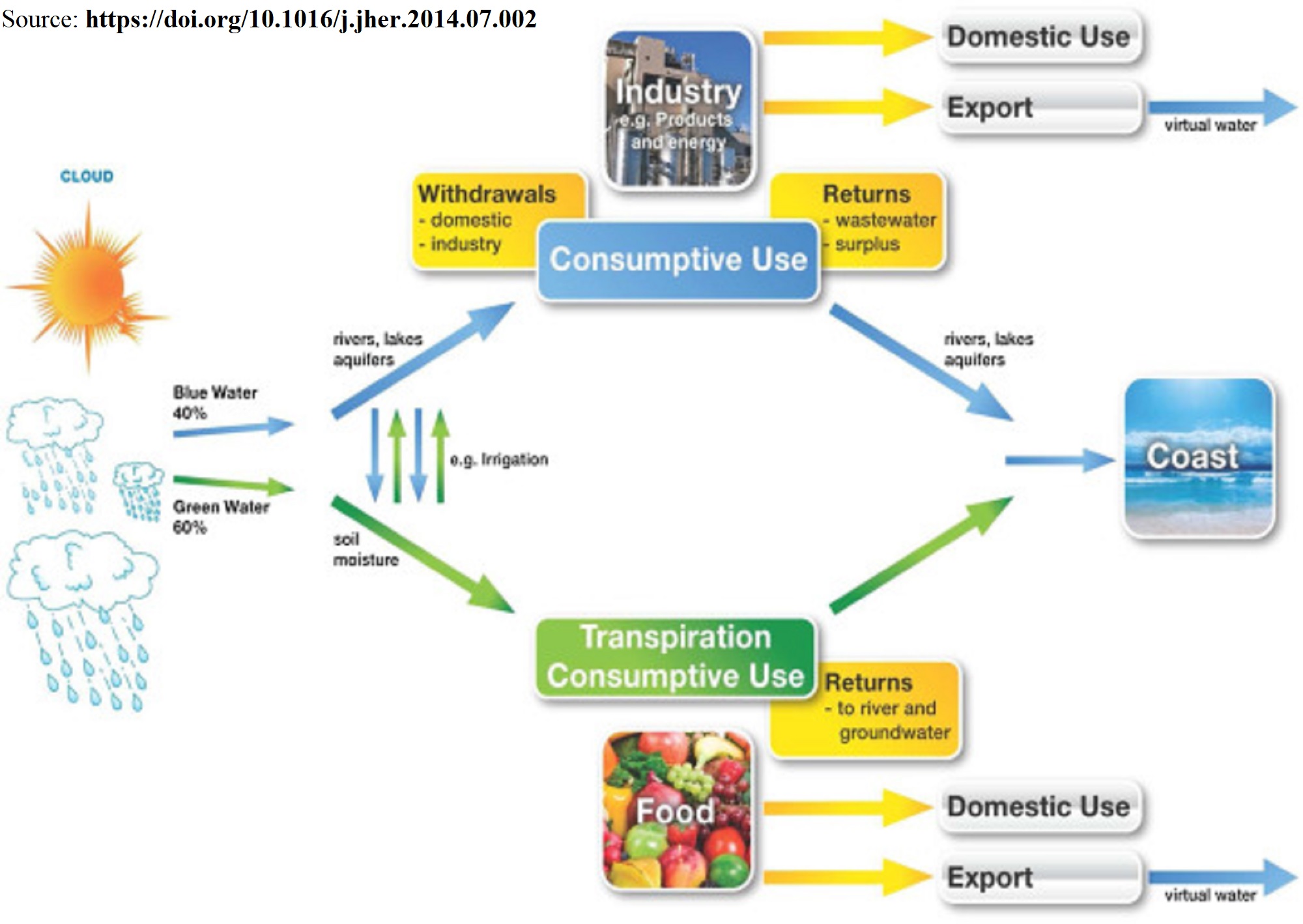

The purpose of these two surveys as part of a multi-institution grant on climate change research and education is to gain additional insight on the ‘Water quality’ and ‘Soil carbon markets’ issues. The time required to complete these surveys should be no more than 10 minutes. Please complete the surveys. If you have any additional questions regarding these surveys, please contact the lead PI, Dr. Rachna Tewari, at rtewari@utm.edu

PS: This being an exploratory study, anyone engaged in agriculture or livestock production of any scale could complete the survey. The survey has been approved by UTM IRB as an exempt study.

Water quality:

https://utk.questionpro.com/a/TakeSurvey?tt=3JvQhqvdhp%2BCCR4ED4Ig2ntMHws332I/