A number of questions have arisen on how to manage the glyphosate-resistant (GR) Johnsongrass that is very prevalent in some corn fields of south west Tennessee. Much of this corn is now in the V2 to V3 corn growth stage so some decision has to be made fairly quickly before the fields dry. Continue reading

Category Archives: Corn

Tennnessee Variety Test Program Survey

Things have been busy this past month in the Tennessee variety test program as entries continue to roll in for our 2017 corn and soybean tests. This year we will be testing a total of 86 corn grain hybrids, 11 corn silage hybrids, and 195 soybean varieties across the state of Tennessee.

We know the variety test program is important to many of you. In order to make sure this program continues to meet your needs, we’d like some feedback from you!

If you are a Tennessee corn, soybean, wheat, or cotton producer, please take a few minutes to help us out by taking this survey. Producer – Variety Test Survey

If you are not a producer, but you provide folks with advice on variety selection (scout, retailer, seed company rep), then please take this survey. Industry – Variety Test Survey

Thanks for your help as we continue to figure out ways we can better serve you through our Tennessee variety test program!

Weed Control with your Cover Crop

With planting just around the corner, there are a few management considerations of cover crops that are being used for weed control. There is no single best way to manage all cover crops prior to any given cash crop. Tailoring the cover crop to best fit your cash crop can make a difference in the ultimate success of your weed control program. Continue reading

With planting just around the corner, there are a few management considerations of cover crops that are being used for weed control. There is no single best way to manage all cover crops prior to any given cash crop. Tailoring the cover crop to best fit your cash crop can make a difference in the ultimate success of your weed control program. Continue reading

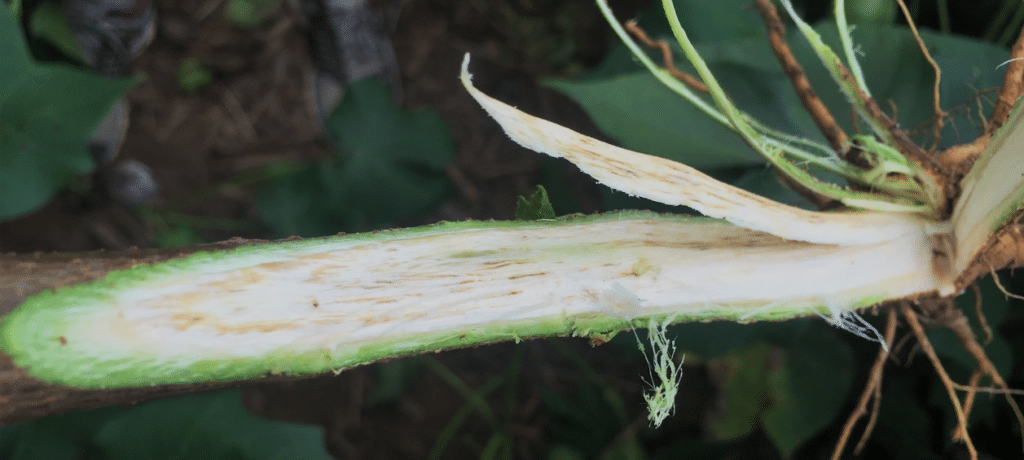

Verticillium Wilt in Tennessee Valley Cotton

The new publication, “W 403: Verticillium Wilt in Tennessee Valley Cotton” provides background on Verticillium wilt, summarizes recent variety trial results, and highlights other practices that can reduce the impact of the disease. Continue reading

Pest Management and Cover Crops

There is growing discussion and interest in the use of cover crops, mostly commonly in soybean but also in corn and cotton. Some of the benefits seem pretty intuitive and include improved control of erosion and the buildup of organic matter. Another obvious benefit is NRCS programs which pay growers to plant specified cover crops. Dr. Larry Steckel and his students have also shown benefits of cover crops in reducing the emergence of Palmer pigweed and some other weeds. However, having said all that, there are some concerns and unknowns about how cover crops might affect populations of soil and seedling pests. Continue reading

Early Corn Burndown Considerations

The crazy warm and mostly dry February has many folks thinking about planting March corn. If this is the case on your farm, it is time to be applying burndown. This is particularly true for fields infested with ryegrass. Continue reading

Tennessee Grain & Soybean Producers Conference

The 2017 Tennessee Grain & Soybean Producers Conference is being held at the Dyer County Fairgrounds in Dyersburg, TN on Thursday, February 2nd. On-site registration begins at 7:45. The programs ends after lunch following the Keynote Address by Harrison M. Pittman, Director, National Agricultural Law Center (University of Arkansas System Division of Agriculture) on “Ag Law Update: Recent & Emerging Issues for the Ag Industry”. Preliminary Agenda (updated)

2017 Middle TN Grain Conference

The twelfth annual Middle Tennessee Grain Conference set for Thursday, January 26 at Coffee County’s Fairgrounds in Manchester offers farmers insight to a number of emerging corn, soybean, and wheat production concerns. The conference is scheduled to get underway with registration beginning at 7:30 am. Registration is $20 at the door or $10 if participants pre-registering by Noon, Monday, January 23 through their local UT Extension office. Registration fees include the program and materials, refreshments, lunch, a copy of the conference proceedings, and a grain conference cap. View Program