Corn: Since the market’s open on Monday morning, September corn futures have declined by approximately $0.11. This decline in prices may cause some producers to make some last minute changes to their planting intentions. With the planting intention report due out on March 31st, we will begin to see the market try to buy more acreage. This decline in prices is somewhat puzzling due to better export sales, acceptable demand from ethanol plants, and the expectation of lower acres in 2017. Continue reading

Category Archives: Farm Management

UT Commodity Market Update 3/17/2017

Corn: Over the past week, corn futures have struggled to gain ground. September corn futures have increased by $0.03 since the markets open on Monday. As the dollar continues to strengthen, corn exports will continue to face headwinds. However, ethanol production continues to remain relatively robust either due to building of stocks or an increase in gas consumption. The USDA will release their planting intentions report on March 31st. This will be the next major milestone for the corn market. New crop corn basis for West TN continues to remain negative with an average of -$0.12.

Picking Capacities in the MidSouth

There is considerable excitement surrounding cotton on the heels of the Farm and Gin Show. From visiting with those in the industry across the Mid-South, I believe TN and nearby states may see larger increases than those initially estimated by the National Cotton Council for the 2017 season. Given the increases in acreage, picker capacity has been a topic of conversation over the past few weeks. Many sold basket equipment several years ago with plans to purchase a module building picker if cotton made its way back on the farm. Now that cotton is coming back, how much cotton can you typically feed through one picker in Tennessee? Mississippi? Missouri? What about capacities in states outside the Mid-South? Continue reading

UT Commodity Market Update 3/3/2017

Corn: Over the past month, corn futures have been trading in a relatively sideways pattern. However, the past few days have allowed cash bids for new crop corn to be near $4.00 levels. Based on the UT Extension Crop Budgets, a producer could potentially lock in a profit at this price level, assuming an average yield of 150 bushels per acre. Private estimates are currently projecting corn acres to be lower in 2017 compared to last year’s levels. Continue reading

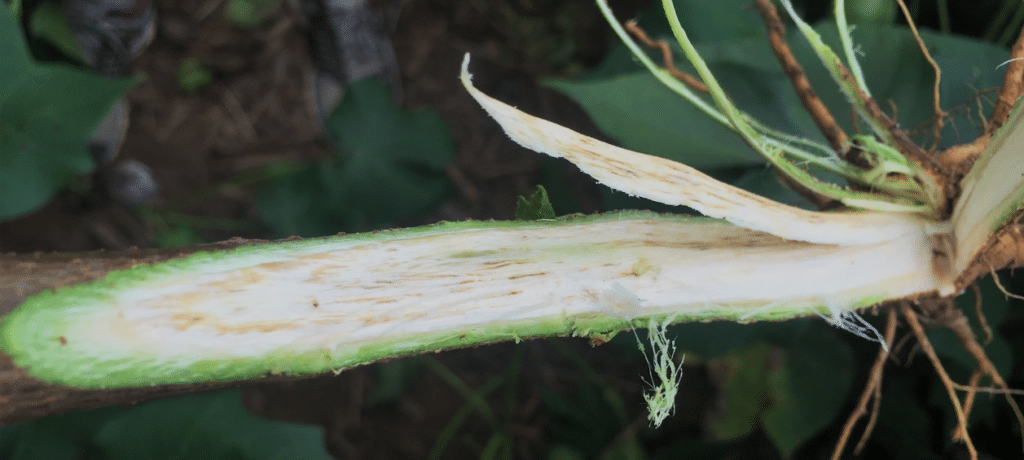

Verticillium Wilt in Tennessee Valley Cotton

The new publication, “W 403: Verticillium Wilt in Tennessee Valley Cotton” provides background on Verticillium wilt, summarizes recent variety trial results, and highlights other practices that can reduce the impact of the disease. Continue reading

Managing a New Kind of Risk

In agriculture, we are constantly faced with risk. Farmers are faced with the risk of adverse weather conditions, volatile commodity markets, and many other production risks. As an Extension Farm Management Specialist, I try to communicate to producers the options they have to reduce their overall risk exposure.

I like to narrow down the areas of risk that farmers must manage to two main areas: financial risk and production risk.

UT Commodity Market Update 1/20/2017

West Tennessee Grain Bids 1-20-2017

Corn: September corn futures increased by $0.10 over the past week. Corn exports have been strong over the past weeks. That along with the news that the RFS looks to remain in place have allowed corn futures to climb higher for the fourth straight week. Brazil and Argentina will begin their corn harvest next month, which could shift demand from U.S. corn to the South America. The size of their crop could impact U.S. corn prices and take the top out of this rally.

UT Commodity Market Update 1/6/2017

West Tennessee Grain Elevator Bids can be viewed here: West Tennessee Grain Bids 1-6-2017

Corn: September corn futures have increased by $0.10 over the past two weeks. The increase can be attributed to strong export sales and a better sentiment across the commodity complex. Over the past month, the increase in oil prices and stock prices has created a positive mood that continues to spill over into commodity markets. Despite the $0.10 increase in prices, the corn market is limited by large supplies due to the extremely large 2016 corn crop. This will limit any upside in corn prices. Continue reading