Corn: September corn futures have rallied this holiday week in part due to the strength gained from the soybean market. However, that says very little given the decline that we have experienced in the corn markets since we put the crop in the ground. The below chart shows just how much corn futures have fallen since spring planting. Continue reading

All posts by Danny Morris, Ext Area Specialist - Farm Management

UT Extension Commodity Market Update

Corn: September futures were down $0.03 today. For the week, corn has declined $0.13. The decline was primarily caused by the enactment of a 25% tariff on $50 billion worth of Chinese imports. Going forward, weather should dictate market prices as the crop year progresses. Planting progress for continues to march forward with 92% of the crop having been planted as of 5/27/2018 with 72% having already emerged. The current crop rating is 79% good-to-excellent. Locally, new crop basis for corn averaged -$0.08 as of today’s market close.

West Tennessee Grain Bids can be viewed here: West Tennessee Grain Bids 6-1-2018

UT Extension Commodity Market Update

Corn: Since the beginning of May, September corn futures have traded in a sideways pattern. The mid-day price of $4.14 for the September contract is only two cents higher than the closing price of $4.12, which occurred on May 1st. The sideways pattern can be attributed to a few things. We have experienced some delays in parts of the Midwest. However, as of May 20, we have already planted 80% of the crop, which is in line with the 5-year average. We have also yet to hit volatile stages of the growing season when weather dictates the market price direction. These factors combined with a not-so upsetting WASDE report this month has resulted in the market not swinging wildly in either direction. New crop corn basis is averaging -$0.09 as of today. Continue reading

UT Commodity Market Update – 5/4/2018

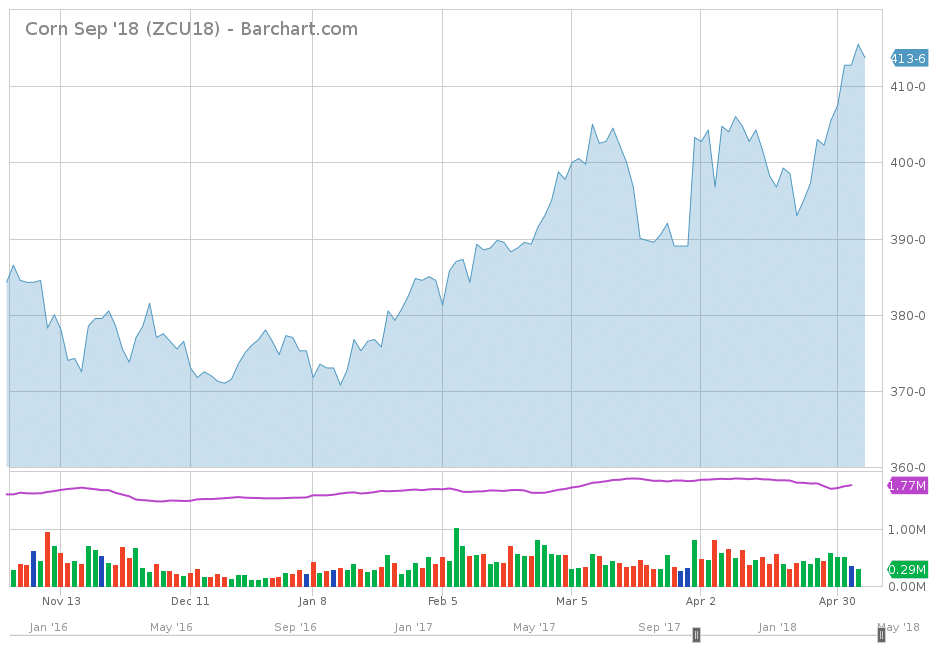

Corn: Since the beginning of the year, the September futures contract has increased by $0.40. An interesting fact is that of this increase, $0.21 has occurred over the last two weeks. The below chart reflects the recent run-up in corn futures:

Looking at the above the chart, obviously, something is driving the market. This begs the question as to what is causing the uptick in prices. Most of the nation’s corn crop is planted in April and by mid-May. Continue reading

UT Commodity Market Update 3/16/2018

Corn: Since Monday’s market open, May corn futures have declined by $0.05 while September futures have only decreased by $0.02. Corn futures hit a seven month high earlier this week before they began to decline. Corn exports have been excellent due to a lack of competition from South America. Last week’s export sales of 103 million bushels set a marketing year high for the 2017/2018 marketing year. Hopefully, farmers were proactive in marketing their crop and captured some profitable sales while corn futures were at these recent highs. Locally, new crop corn basis averaged -$0.12.

UT Commodity Market Update 3/8/2018

Corn: So far this week, corn futures have been on a steady climb. May corn futures have increased $0.08 while September corn futures increased $0.07. The increase can be attributed to the USDA’s latest World Agricultural Supply and Demand Estimate (WASDE) report that was released today. The USDA is projecting higher exports and increased domestic demand due to higher ethanol production. Export figures were increased by 175 million bushels to 2.225 billion bushels. The cause of the increase is due primarily due to U.S. corn being competitive in the export market, strong sales, and lower competition from Argentina. Continue reading

UT Commodity Market Update 2/19/2018

Corn: Last week, March corn futures closed $0.03 cents higher while September corn futures closed $0.03 higher as well. The spike higher in soybean prices is continuing to pull the other grains along with it. However, in part, the latest USDA’s World Agricultural Supply and Demand Estimate (WASDE) indicated that corn exports will continue to improve, which will cause a reduction in ending stocks. Continue reading

UT Commodity Market Update 2/2/2018

Corn: March corn futures traded $0.04 higher for the week. September corn futures traded $0.04 for the week as well. The average local basis for new crop corn averaged -$0.13. The higher futures can be attributed to better than expected exports. Also, the size of the corn crop in Argentina is expected to be lower than previously thought. Abnormally dry growing conditions are causing analysts to think that the size of the overall crop will be reduced in USDA’s next report. The size of the Brazilian corn crop is also presumed to be reduced as well. Continue reading