All posts by Chuck Danehower, Extension Area Specialist - Farm Management

Crop Production – Tennessee

Released: November 8, 2018

Record Tennessee Corn Yield Projected

Corn production in Tennessee is forecast at 119 million bushels, down 1 percent from the October forecast and down 2 percent from the previous crop. Yield was estimated at a record 173.0 bushels per acre, down 1.0 bushels from last month and up 2.0 bushels from the 2017 level. Acres for harvest as grain were estimated at 685,000 acres, down 25,000 acres from 2017. The U.S. corn production is forecast at 14.6 billion bushels, down 1 percent from the October forecast and up slightly from 2017. Based on conditions as of November 1, yields are expected to average 178.9 bushels per acre, down 1.8 bushels from last month and up 2.3 bushels from 2017. Area harvested for grain is forecast at 81.8 million acres, unchanged from the October forecast and down 1 percent from 2017. Continue reading at NovCrop18_TN.

Tennessee Weekly Crop & Weather Report

RAINS PUT FIELD WORK ON HOLD

Mid-week rains once again put a halt to field activities, but not before some harvest of field crops occurred. Despite mostly good yields, soybean and cotton producers reported quality issues due to wet conditions. Winter wheat planting continued as the weather allowed. As cooler temperatures approach, livestock producers were reporting adequate hay supplies. There were 3.5 days suitable for fieldwork. Topsoil moisture rated 1 percent short, 58 percent adequate, and 41 percent surplus. Subsoil moisture rated 2 percent short, 68 percent adequate, and 30 percent surplus. Continue reading at TN_11_05_18. The U.S. Crop Progress report can be read at CropProg-11-05-2018.

Tennessee Market Highlights

Corn, cotton, and soybeans were up; and wheat was mixed for the week.

On Thursday, positive comments from President Trump regarding trade negotiations with China sparked a 30 cent rally in soybean futures, ending a three week slide in soybean futures that saw January futures prices decline from $9.00 to below $8.50. While the market reacted positively, there is still a long way to go before a long term resolution with the Chinese is likely. Moving forward volatility is likely to remain in soybean markets as positive/negative trade news is released. Continue reading at Tennessee Market Highlights.

Crop Insurance & Soybean Damage

This topic was discussed at our recent Generic Base/Seed Cotton meetings and with the soybean damage some producers have been seeing was worthy of being posted again on the blog. In summary, use your grain elevator ticket production bushels to sign up for the Market Facilitation Program at FSA rather than production that has been adjusted for crop insurance. Please read the article for details. Chuck

For more information, contact the author at:

Dr. Aaron Smith

aaron.smith@utk.edu

This year has been a challenging one for soybean producers across Tennessee. Trade disruptions and record national average yield has pushed cash prices well below $8.00 in many locations in Tennessee. Additionally, the extended wet weather in late September has impacted soybean quality. Damage is ranging from minor with small discounts to extensive damage with loads getting rejected at elevators and barge points.

Farmers experiencing any of the following should contact their crop insurance agent immediately and report the issue: 1) notice quality issues in standing soybeans, 2) have cut a portion of a field and had quality dockage at the elevator, 3) or had a load rejected. A crop insurance adjustor is supposed to visit the field(s) in question within 24 hours of filing a claim to determine the extent of the damage and the steps forward.

Quality issues will be difficult to overcome when marketing the crop. For example, damage discounts to cash prices can be $1 to $1.50 for 5 to 9 percent damage, resulting in cash soybean prices well below $7.00 per bushel. Continue reading at Soybean Damage.

Tennessee Weekly Crop & Weather Report

FIELD ACTIVITIES RESUME

Drier conditions allowed farmers to resume harvest activities until late week rains forced them out of their fields again. Yield reports were mixed with some producers fearing that recent rains had adversely affected yields. Pasture conditions declined a bit with a few areas reporting frost, but, for the most part, conditions remained good. There were 3.9 days suitable for fieldwork. Topsoil moisture rated 2 percent short, 74 percent adequate, and 24 percent surplus. Subsoil moisture rated 2 percent short, 82 percent adequate, and 16 percent surplus. Continue reading at TN_10_29_18. The U.S. Crop Progress report can be read at CropProg-10-29-2018.

Tennessee Market Highlights

Corn and cotton were up, soybeans and wheat were down for the week.

Futures prices declined for the week as tepid weekly export sales numbers for corn and soybeans resulted in further concerns about dispersing this year’s large domestic crop. Soybean and wheat export commitments (outstanding sales and accumulated exports) are well behind the pace to meet USDA projections. Currently, wheat export commitments are 45% of the USDA’s marketing year goal. This compares unfavorably to last year at 68% and the five year average of 64% for the same time period. Similarly, soybean export commitments are at 38% of USDA’s marketing year total, compared to 50% last year and a five year average of 57%. Chinese tariffs have obviously played a substantial role in reduced soybean export commitments. However, these are troubling numbers during harvest when export sales are typically at their highest. Reduced exports will increase domestic carry-over and further decrease cash prices. Continue reading at Tennessee Market Highlights.

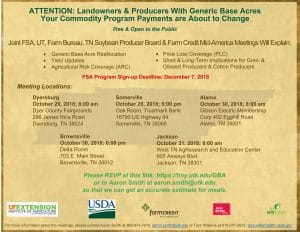

Generic Base/Seed Cotton Program Meetings October 29-31

University of Tennessee Extension is hosting 5 meetings to assist producers and landowners with finalizing their decisions regarding generic base acres and seed cotton as a result of the Bipartisan Budget Act of 2018. The meetings will provide information on: updating yields, options for reallocating generic base, 2018 ARC and PLC program selection for seed cotton base acres, and the short & long term implications of the decisions for landowners and cotton, grain, and oilseed producers. Also on the program will be how to handle seed damage through crop insurance and details on signing up for the Market Facilitation Program

For producers and landowners that have already made reallocation and program election decisions, the meetings will provide an opportunity to review (and change) decisions based on: 1) updated 2018 county yield data; and 2) recent policy developments in the 2019-2023 Farm Bill negotiations.

The sign up deadline at FSA service centers is December 7th. Meetings will be held in Dyersburg, Somerville, Alamo, Brownsville, and Jackson (October 29-31; See Generic Base Meetings Flier 2018). We encourage attendees to register so we can get an accurate head count for meals.