In 2022, crop producers will face a completely different cost structure and risk profile than previous seasons. The rise in fertilizer prices and other inputs have been well documented and discussed. Additionally, many producers are aware that some crop protection products may be difficult to source in the quantities required for the 2022 production year. However, another important cost consideration in 2022 will be land expense. Particularly if producers are on a straight crop share (for example, ¼ of gross revenue).

Last year, the December corn futures contract averaged $4.60/bu from January 1 to March 31. This year the average as at February 15, for the December contract, was $5.70/bu. So, assuming an expected yield of 175 bu/acre and a ¼ crop share would result in budgeted land expenses of $201.25/acre in 2021 and $249.38/acre in 2022. Prices are up so both landowners and producers benefit, correct?

If prices hold and yield is achieved the landowner clearly benefits – their share of revenue has increased $48.13/acre, compared to the previous year. The producer’s benefit is far less certain given changes in costs, even if prices hold and yield is achieved. UT crop budgets estimate variable cost for corn production in Tennessee at $621.71/acre in 2022 compared to $414.36 in 2021. Removing crop share expense and variable costs leaves the producer with $126.42/acre ($997.50 – $249.38 – $621.71) to cover fixed costs, living expenses, return on investment, and general farm overhead in 2022. Compared to $189.39/acre ($805 – $201.25 – $414.36) in 2021. This is a $62.98/acre reduction in budgeted partial returns to the producer from 2021 to 2022.

So, what can be done?

First, there are four important points that should be made. 1) This is not an easy conversation for producers or landowners to have; 2) there is tremendous value to both the producer and landowner embedded in mutually beneficial long term business relationships; 3) competition for crop land across Tennessee is intense; and 4) there are advantages and disadvantages to all lease arrangements for both producers and landowners.

Three potential land lease considerations that can be explored to address the changes in cost structure and risk profile are:

1) Moving to a cash rental rate.

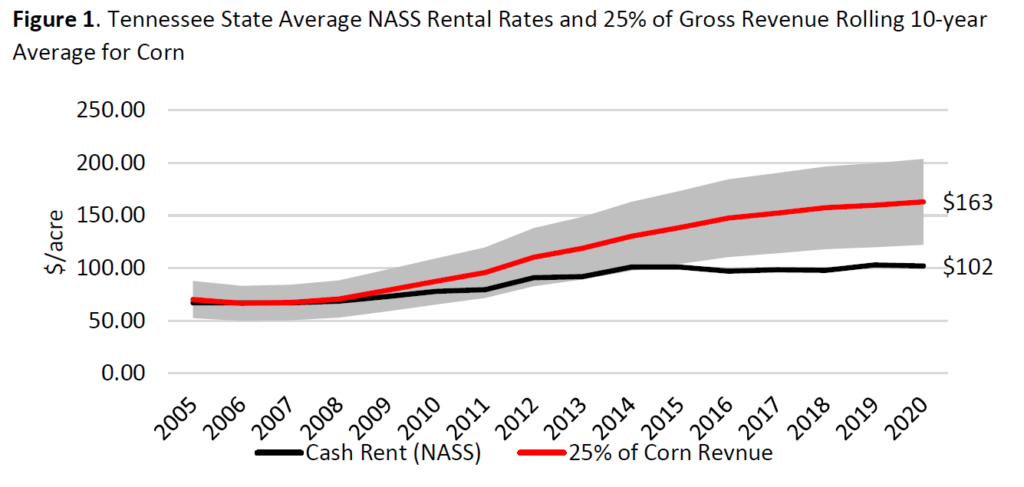

Cash rental rates vary tremendously across the state and within counties. So, one way to estimate a starting point in negotiating cash rental rates is to examine a 10-year rolling average of 25% of gross revenue by commodity (Figure 1 for corn using state averages). This provides a market driven adjustment that smooths the returns to the producer and landowner. To calculate this for an individual farm take the actual production history (APH) yield, multiply by the average sales price for the commodity for the marketing year, multiply by 25%, and average over the previous 10-years. This will provide a productivity and market-based estimate for cash rents over time (each year the most recent

year is added to the calculation and the most distant year is dropped). At the very least it can be a starting point for negotiations between parties acting in good faith.

2) Landowner shares in production expenses and gross revenue

Having discussions and negotiating a fair allocation of expenses and revenue can be challenging and time consuming. What expenses should be shared? University of Tennessee has work sheets that producers and landowners can utilize to allocate a portion of expenses to the landowner and producer (see resources below). Common expenses that can be considered for share are fertilizer, crop protection products, and crop insurance premiums.

3) Hybrid Arrangements (Cash Base + Share of profits)

An agreed upon cash rental rate plus a bonus payment, based on profitability at the end of the year, can be beneficial to both the landowner and producer. The landowner is guaranteed an initial payment for his land, the producer has a defined initial expense. If the year is profitable a predetermined portion of profits are paid to the landowner as a bonus or share of the profitable outcome.

There is no one size fits all for addressing leased land expenses, however maintaining an honest dialogue between property owners and producers can provide the foundation for a mutually beneficial long-term relationship. Leaving an existing crop share arrangement in place may be the best solution, however producers should be cognizant that the risk profile has shifted compared to previous years. All lease arrangements have advantages and disadvantages for producers and landowners. The goal of negotiations is to find an arrangement that fairly allocates financial rewards and risks between the two parties.

Resources

Introduction to Farmland Leasing: https://extension.tennessee.edu/publications/Documents/PB1816-A.pdf

Farmland Cash Leases: https://extension.tennessee.edu/publications/Documents/PB1816-B.pdf

Crop-Share Leases: https://extension.tennessee.edu/publications/Documents/PB1816-C.pdf