Corn: September corn futures have rallied this holiday week in part due to the strength gained from the soybean market. However, that says very little given the decline that we have experienced in the corn markets since we put the crop in the ground. The below chart shows just how much corn futures have fallen since spring planting.

With this decline in corn futures, profitability will take a large lunge downward as well. Part of the reason for the decline has been the lack of a weather scare. To date, we have received more than adequate rainfall and currently have a water surplus in our soil profiles, at least here in West Tennessee. On July 2, the USDA released their crop condition report. The nation’s corn crop was rated at 76% being good-to-excellent. The key corn growing states such as Iowa, Illinois, and Indiana, the crop condition there is north of 75% good-to-excellent. Of course, their crop is not as far along as ours, but the crop is set up for a good year. It would seem that any unsold bushels could be priced at lower levels than many producers would like. This means that farmers with unsold corn need to monitor futures and look for good opportunities to sell their grain. Otherwise, producers may be looking at putting their corn in the bin and hope for an improvement in basis post-harvest. Locally, new crop basis averaged -$0.04 as of today’s market close.

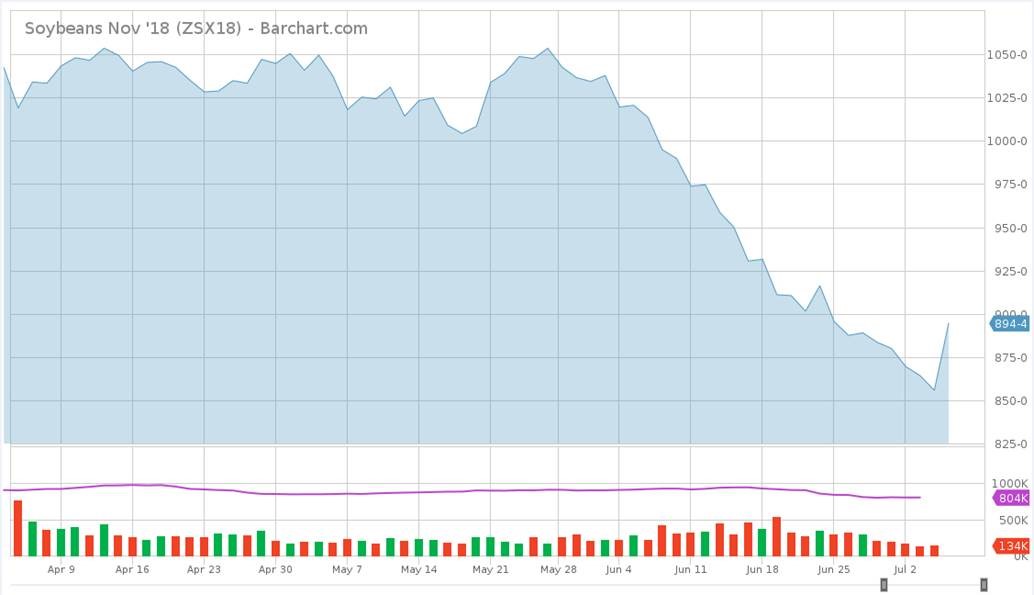

Soybeans: November futures have on a rapid decline since the talk, and eventual implementation, of Chinese tariffs. Close to the end of May, November soybean futures traded above $10.50. Unfortunately, since then, November futures have declined by more than $1.50. The below chart illustrates that very point.

Today, soybean futures did turn around their rapid descent. This can be attributed to solid exports despite the tariff on U.S. soybeans. In my opinion, much of the decline was attributed to a massive oversell of the soybean market. The fact remains that China needs soybeans to feed their livestock and citizens. We and South America are the ones that own most of the soybeans that they need, meaning they will still buy U.S. soybeans. However, the tariff is a massive millstone around the neck of soybean futures which will keep any major rally at bay. We have entered into a new trading range for soybean futures. Producers with unsold soybean futures will likely find themselves in a dark place at the moment with local soybean bids being sub $9.00 levels. Producers need to keep in mind that we are still in a weather market and any rally in futures is indeed a selling point, particularly if storage is not an option. Locally, new crop soybean basis averaged -$0.14 as of today’s market close.

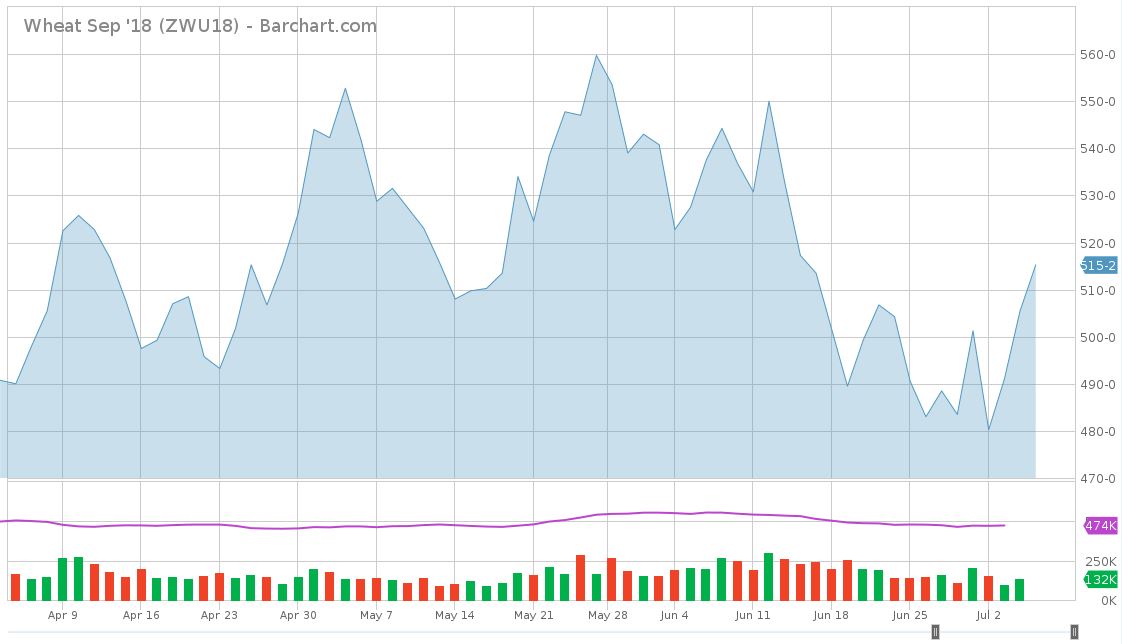

Wheat: Wheat futures have been on a roller coaster this year. The wheat complex has truly been a game of tug of war between two market fundamentals. The first being the world is still full of wheat and ending stocks are high, which bodes well for lower prices. However, in the U.S. the spring wheat crop has been hit hard by adverse weather conditions that caused wheat futures to rally back in the late spring and early summer.

That being said, producers with storage will likely be able to pocket a little extra cash due to the rally of wheat futures above $5.00. Higher futures combined with an improvement in basis will allow farmers with storage to capitalize on their investments in grain bins. After all, times like these are why you put them up in the first place. Locally, cash basis for wheat averaged $0.11 in West Tennessee.

Cotton: December cotton futures remain well above 80.00 with today’s futures closing at 84.45. Today’s increase shows support for futures to trade north of 80.00. Equities, or loan options, have softened due to the decline in futures over the past few weeks. Equities reached levels above $0.30; however, they have since declined to a current range of $0.25 to $0.26. Producers with unsold equities need to remain in contact with their cotton brokers to remain up to date on equity offers.

Take Home Message: This year has been a year where economics, weather, and politics have directly impacted futures prices. Farmers with unsold grain will need to look for any potential rally in prices. In corn, the chance for a rally looks very slim with as much rain as we have received. Soybean futures keep making massive movements, but today’s levels are still below $9.00, which makes it very difficult to sell any more bushels. I ran several farm plans this year and the result was the same for nearly everyone. Soybean prices below $9.00 resulted in a net loss. In those price scenarios, I was assuming an average yield of 45 to 50 bushels per acre and accounting for all variable and fixed expenses. Cotton prices continue to remain at favorable levels for producers. Of course, profitability for cotton farmers will be dependent on yield. We just have to keep on keeping an eye on these markets, knowing our cost of production, and sell according. If you need any assistance with any of these areas, feel free to reach me directly at danhmorr@utk.edu or contact your local UT Extension office to ask about the Farm MANAGE program.