Corn: Since the beginning of May, September corn futures have traded in a sideways pattern. The mid-day price of $4.14 for the September contract is only two cents higher than the closing price of $4.12, which occurred on May 1st. The sideways pattern can be attributed to a few things. We have experienced some delays in parts of the Midwest. However, as of May 20, we have already planted 80% of the crop, which is in line with the 5-year average. We have also yet to hit volatile stages of the growing season when weather dictates the market price direction. These factors combined with a not-so upsetting WASDE report this month has resulted in the market not swinging wildly in either direction. New crop corn basis is averaging -$0.09 as of today.

Soybeans: November soybean futures have experienced a wild ride since the beginning of May. Since May 1st, the November soybean contract has traded $0.40 lower down to $10.10 on May 20th. Since May 20th, soybean futures for the November contract have rallied more than $0.45. Why has the soybean market be so volatile you ask? The concern of a trade war with China has been the source of a lot this volatility. As of today, it seems that the talk of tariffs on U.S. soybeans has subsided. The size of the South American crop along with currency rate exchanges will also impact demand for U.S. soybeans. New crop soybean basis is averaging $0.16.

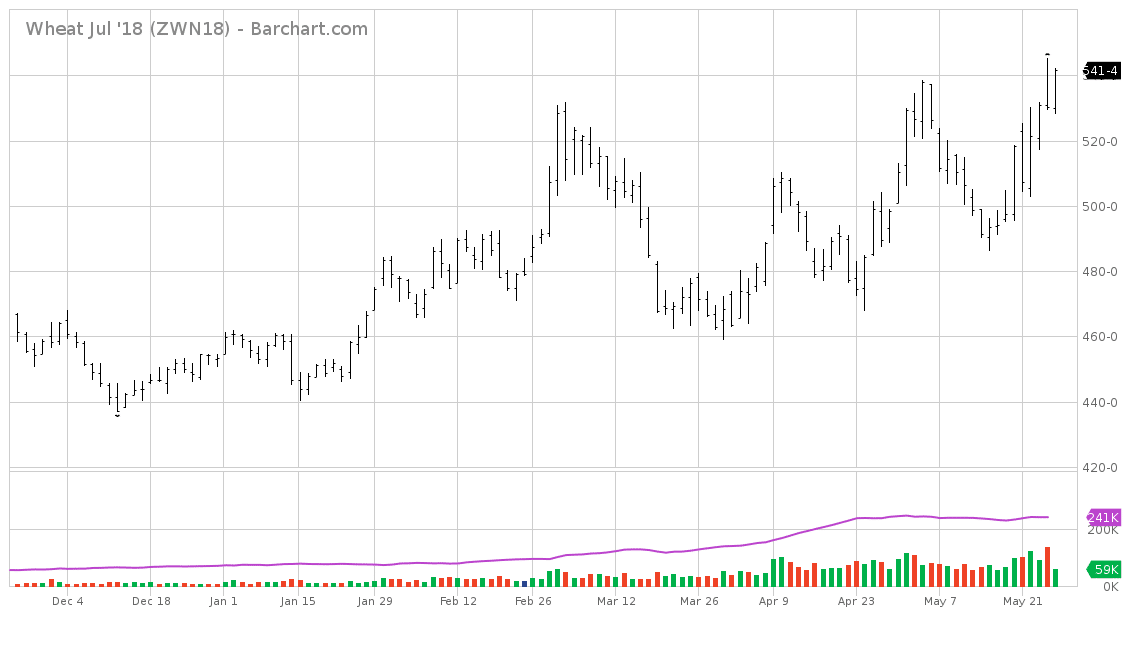

Wheat: The July wheat futures contract has been on a very wild ride this month. The chart below illustrated that very point.

The rally in the wheat market can be mostly attributed to dry weather in the key growing wheat states along with some abnormally dry weather in parts of Russia. The wheat market has given producers quite a nice gift as our wheat harvest seasons is drawing nigh here in Tennessee. New crop basis for wheat is averaging $0.03 today.

Cotton: Cotton equities are averaging $0.28 today, assuming a loan price of $0.52 per lb. The rally in cotton can be attributed to stronger demand for high quality cotton as the difference between polyester and fibers is coming closer together. Weather forecasts for Texas will be news items to watch for those with unpriced cotton equities.

Take Home Message: The rally in wheat futures is likely a good selling opportunity for those with unpriced bushels. Also, those with unpriced cotton equities, it is crucial that you keep an eye on the what your brokers are offering. For corn and bean producers, the chance to price grain may come in the next few months. Producers should be mindful of their production costs to be sure to price sales at profitable price levels. If you need assistance in adopting farm planning tools to aid in this, contact your local UT Extension Farm Management Specialist for assistance