Corn: September corn futures closed $0.02 lower for the week. Today, corn futures were able to recapture a portion of what was lost after yesterday’s USDA report. The latest World Agricultural Supply and Demand Estimates (WASDE) was released yesterday morning. This report contained very few surprises for the corn market. The USDA did lower the national yield by 1.2 bushels per acre from 170.7 to 169.5. This projected decline in the national yield did lower the USDA’s expected ending stocks for corn. However, the fact still remains that corn stocks continue to remain very high and are preventing any substantial rally in corn prices. The USDA did lower total demand for corn by 50 million bushels.

According to the USDA, the U.S. corn crop is in pretty good shape. As of 8/6/2017, the USDA rated 60% of the crop as being good-to-excellent. Key growing states like Illinois, Iowa, and Minnesota continue to hang on to good crop ratings. As of this week, 93% of the crop is silking with 42% have reached the dough stage. In Tennessee, some farmers have already begun to harvest their corn crop. Locally, new crop corn basis averaged -$0.14 as of today’s market close.

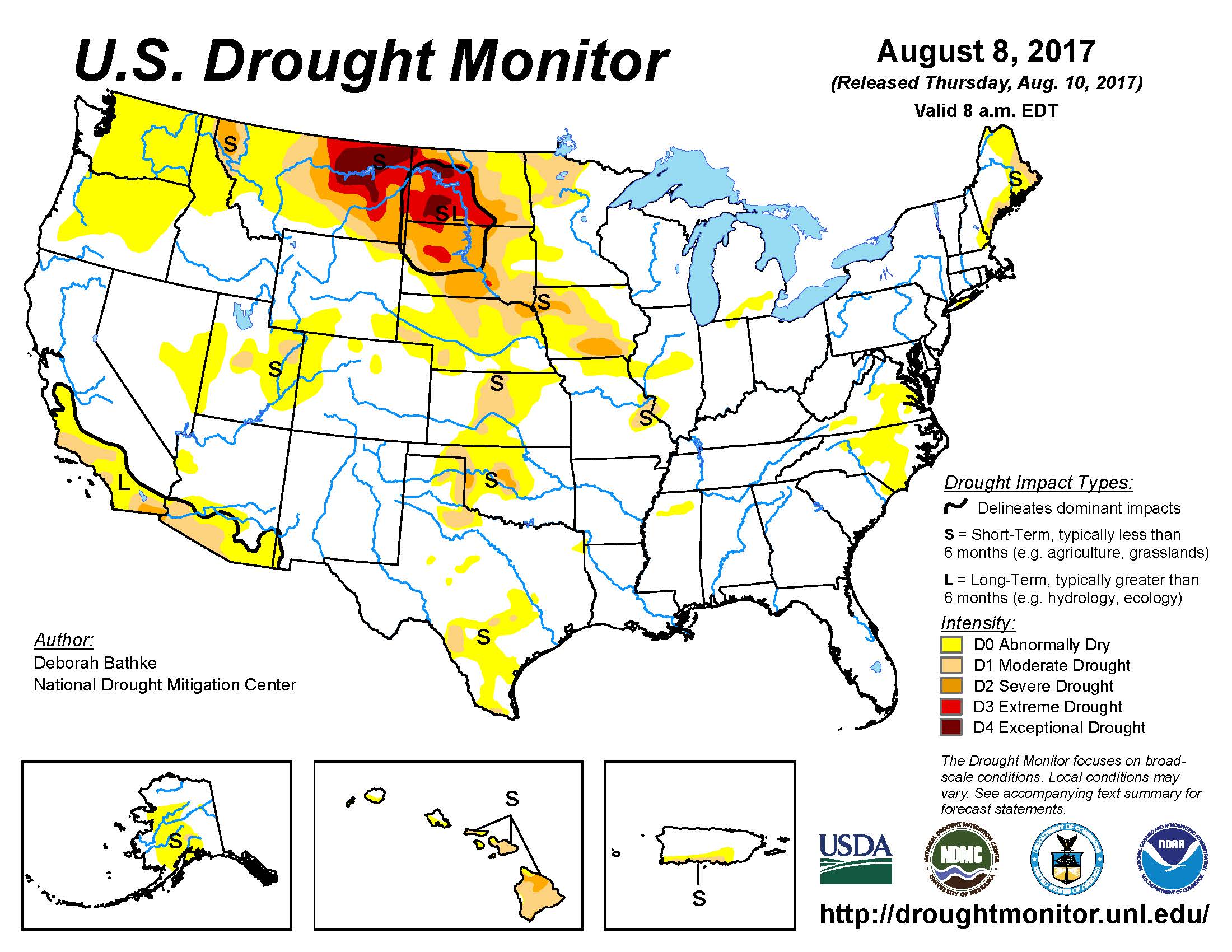

Beans: To say that soybean prices took a stumble after yesterday’s report would be an understatement. Yesterday, November soybean futures declined by $0.33. The USDA increased the national yield from 48 bushels per acre to 49.4 bushels per acre. This increase was higher than the average trade estimate. As a result of the increase in the national yield, projected ending stocks were increased by 15 million bushels. One saving grace is the continuation of strong demand for soybeans. The USDA increased production by 88 million bushels while simultaneously increasing soybean use by 66 million bushels. Soybean ending stocks remain high and are projected to increase. Any chance at a rally between now and harvest will hinge upon a drastic change in supply. However, the forecasts for the Midwest continue to remain favorable. The figure below shows the latest U.S. Drought Monitor. As you can see, key growing states are not dry at the moment.

The USDA actually increased the rating of the U.S. soybean crop to 60% good-to-excellent. The lack of hot temperatures in key growing states is the main reason that quality ratings for the 2017 soybean crop have not declined. The USDA’s latest crop report rated 60% of the crop as being good-to-excellent. The combination of good crop ratings, the largest soybean crop ever planted, and high ending stocks do not paint a picture for higher soybean prices. Locally, new crop soybean basis averaged -$0.17 as of today’s market close.

Wheat: July wheat futures declined by $0.16 over the course of the week. The latest WASDE report did contain any large surprises for the wheat market. The WASDE report did indicate that world supplies of wheat are expected to increase for the third year in a row. An increase in supply spells lower prices, which is not good for what many consider already low wheat prices. Locally, new crop wheat basis averaged -$0.13.

Cotton: Cotton equities are currently $0.12 to $0.13 for West Tennessee Farmers. Yesterday’s WASDE report contained a few surprises for the cotton market. The national yield for cotton was increased from 816 pounds per acre to 892 pounds per acre. The increase in supply was somewhat offset by a projected increase in exports. However, the USDA raised ending stocks by 500,000 bales. So, more supply does put a damper on higher cotton prices. Yesterday, December cotton futures declined from above $0.70 at market open to $0.6843 at the market’s close. The increase in production has created a price environment that will make it difficult for cotton futures to climb back above $0.70.

Take Home Message: The latest WASDE report was mostly bearish for all commodity prices. The increase in soybean and cotton yields will make it hard to see a price rally in these two commodities. Farmers should evaluate their costs of production to see what prices levels are profitable before we begin the harvest season.

Local Grain Prices: West Tennessee Grain Bids