Corn, soybean and wheat prices are up while cotton prices are mixed for the week. The March U.S. Dollar Index traded before the close at 79.51, up .28 for the week. The Dow Jones Industrial Average before the close was up 141 points for the week at 12,942. Crude Oil traded before the close at 102.98 a barrel, up 4.31 a barrel for the week. Prices are up this week despite strength of the Dollar which is buoyed by events in Europe. Internal production estimates for Argentina continue to downgrade their crop as the old adage small crops get smaller may also apply outside the U.S. Estimate are starting to drop below USDA’s latest projection which could have a positive effect on U.S. exports. A Chinese delegation made its way through the heartland of the U.S. with stops in Iowa and Memphis with sales agreements announced on soybeans and cotton. Details of whether these will be old or new crop sales are needed before the market gets real excited. Old crop sales would impact the market while new crop sales would be more symbolic. USDA will present its annual Agricultural Outlook Forum February 23-24 and will be the first glimpse of what the new crop year may look like. Markets will be closed on February 20 in observance of President’s Day.

Corn:

Nearby: March closed at $6.41 ¾ a bushel, up 10 cents a bushel for the week. Support is at $6.29 with resistance at $6.52 a bushel. Technical indicators have changed to a strong buy bias. Weekly exports were above expectations at 42 million bushels (39.6 million bushels for the 2011/12 marketing year and 2.4 million bushels for 2012/13). Exports of 5.2 million bushels to South Korea were announced today. There is some concern that there could be a slowdown in corn for ethanol as ethanol plants profit margins get squeezed. For corn in storage, I would use the 50 day moving average price of $6.25 as a price stop.

New Crop: September closed at $5.96 ¾ a bushel, up 12 ¼ cents a bushel since last Friday. Technical indicators have changed to a buy bias. Support is at $5.87 with resistance at $6.04 a bushel. I am currently 10% priced for 2012 production. I have concerns that with a potential corn acreage increase and trend line yields that stocks will build and prices will be lower at harvest.

Cotton:

Nearby: March closed at 91.45 cents per pound, up 0.84 cents since last week. Support is at 90.05 cents per pound with resistance at 93.97 cents per pound. Technical indicators have a sell bias. The Adjusted World Price for February 17– February 23 is 79.56 cents per pound down 2.69 cents. All cotton weekly export sales were 173,200 bales (sales of 101,400 bales of upland cotton for 2011/12; sales of 65,200 bales of upland cotton for 2012/13 and sales of 6,600 bales of Pima cotton for 2011/12). Market reaction was muted to the announcement in Memphis of a $500 million cotton sales agreement with China. This amounts to around 1 million bales. I am currently at 80% priced for 2011 production and would be willing to hold the remainder for an additional rally. I would target the $1 to $1.05 range as a pricing point.

New Crop: December cotton closed at 92.62 cents per pound, down 0.35 cents for the week. Support is at 91.38 cents per pound with resistance at 94.86 cents per pound. Technical indicators have changed to a sell bias. Loan equities have been quoted at 33 cents per pound. Keep in contact with your cotton buyer for current quotes on loan equities and pricing alternatives.

Soybeans:

Nearby: The March contract closed at $12.67 ½ a bushel, up 38 ½ cents a bushel since last Friday. Support is at $12.48 with resistance at $12.82 a bushel. Technical indicators have a strong buy bias. Weekly exports were within expectations at 22.6 million bushels (16.1 million bushels for the 2011/12 marketing year and sales of 6.5 million bushels for 2012/13). Sales agreements with China for the purchase of 452 million bushels were signed this week. Most of this is considered to be new crop and already figured in. On the daily reporting system, sales of 6.4 million bushels for 2011/12 and 101 million bushels for 2012/13 to China were announced and not necessarily expected, hence prices up today. This could be some of an influence of reduced production from South America. Producers who continue to hold stored soybeans should not let prices get away from them and at least use a $12.29 stop as a pricing point should prices drop back to that level.

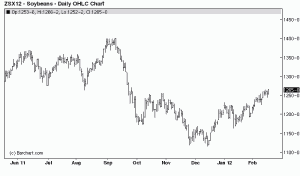

New Crop: November soybeans closed today at $12.62 a bushel, up 22 ½ cents since last week. Support is at $12.46 with resistance at $12.74 a bushel. Technical indicators have a strong buy bias. I am currently priced 5% at $11.94. Use a $12.32 futures stop as a pricing point should prices drop back to that level. If prices move up, I would move my stop up. For chartists, the soybean chart below seems to indicate an inverted head and shoulders move. Prices are right at the neckline which would be bullish if a sustained breakout occurs. In this volatile market, the breakout may not last long. From a chart standpoint, it does bear watching.

Wheat:

Nearby: March futures contract closed at $6.44 a bushel, up 14 cents a bushel since Friday. Support is at $6.17 with resistance at $6.59 a bushel. Technical indicators have changed to a buy bias. Weekly exports were below expectations at 15.7 million bushels (15.4 million bushels for 2011/12 and .3 million bushels for 2012/13). Ukraine did announce they were halting new export sales due to production concerns.

New Crop: July wheat closed at $6.59 ½ a bushel, up 11 ¼ cents since last week. Support is at $6.39 with resistance at $6.71 a bushel. Technical indicators have changed to a sell bias. Drier than normal conditions now and forecast for continued dry conditions in the Upper Plains and parts of Canada through the end of May have offered support for wheat prices. Wheat has also benefited from the increase in corn and soybean prices. I am currently 10% priced for the 2012 crop.