Most of the commercial and state soil testing laboratories in and around Tennessee use and prescribe fertilizer recommendations based on Mehlich 3 soil test extraction method. Most growers may receive soil test results from laboratories that utilizes Mehlich 3 soil test extraction method. However, The University of Tennessee gives fertilizer recommendations based on the Mehlich 1 extractant. This makes it difficult for growers to take advantage of The University of Tennessee fertilizer recommendations. Currently, the Mehlich 1 and 3 conversion equations used in TN were derived from the University of Kentucky, which were based on Kentucky soils (Table 1). Continue reading

Most of the commercial and state soil testing laboratories in and around Tennessee use and prescribe fertilizer recommendations based on Mehlich 3 soil test extraction method. Most growers may receive soil test results from laboratories that utilizes Mehlich 3 soil test extraction method. However, The University of Tennessee gives fertilizer recommendations based on the Mehlich 1 extractant. This makes it difficult for growers to take advantage of The University of Tennessee fertilizer recommendations. Currently, the Mehlich 1 and 3 conversion equations used in TN were derived from the University of Kentucky, which were based on Kentucky soils (Table 1). Continue reading

Category Archives: Cotton

Cotton Focus TODAY (Wednesday) Feb 7th at 8AM at WTREC

The 2024 Cotton Focus Event is TODAY, Wednesday, Feb. 7th starting at 8AM. We have a great lineup of speakers. CCA, Master Row Crop, and Commercial Applicator Points will be available. Lunch will be provided by Tulum. Please find a copy of the agenda below. Look forward to seeing you there!

Agenda set for 2024 Cotton Focus, NEXT WEDNESDAY Feb 7th @8AM

I am happy to report the agenda for the 2024 Cotton Focus has been set and we have a very informative lineup. We will start the morning out with a Cotton Specialist Roundtable with Dr. Brian Pieralisi (MS), Mr. Tyler Sandlin (AL), and Dr. Bradley Wilson (MO) discussing their season observations, tips for 2024, and things they will be watching over the coming year. Next, we will have Dr. Thomas Ducey with USDA from Florence, SC discussing the emerging field of Biologicals- you will not want to miss his section! Our late morning section will include the always valuable updates from Dr. Lori Duncan, Dr. Aaron Smith, Dr. Sebe Brown, Dr. Larry Steckel, Dr. Nutifafa Adotey and Dr. Heather Kelly. Finally, we will close out the meeting with a catered lunch from Tulum. Pesticide and CCA points will be available. Looking forward to seeing each of you there!

I am happy to report the agenda for the 2024 Cotton Focus has been set and we have a very informative lineup. We will start the morning out with a Cotton Specialist Roundtable with Dr. Brian Pieralisi (MS), Mr. Tyler Sandlin (AL), and Dr. Bradley Wilson (MO) discussing their season observations, tips for 2024, and things they will be watching over the coming year. Next, we will have Dr. Thomas Ducey with USDA from Florence, SC discussing the emerging field of Biologicals- you will not want to miss his section! Our late morning section will include the always valuable updates from Dr. Lori Duncan, Dr. Aaron Smith, Dr. Sebe Brown, Dr. Larry Steckel, Dr. Nutifafa Adotey and Dr. Heather Kelly. Finally, we will close out the meeting with a catered lunch from Tulum. Pesticide and CCA points will be available. Looking forward to seeing each of you there!

2024 Cotton Focus on Wednesday, Feb 7th

The 2024 University of Tennessee Cotton Focus is coming up on February 7th from 8AM to 1PM in Jackson, TN at the West Tennessee Research and Education Center (605 Airways Blvd Jackson, TN 38301). Lunch will be provided and CCA, Commercial Applicator and Master Row Crop Points will be available. Tulum will be catering lunch.

The 2024 University of Tennessee Cotton Focus is coming up on February 7th from 8AM to 1PM in Jackson, TN at the West Tennessee Research and Education Center (605 Airways Blvd Jackson, TN 38301). Lunch will be provided and CCA, Commercial Applicator and Master Row Crop Points will be available. Tulum will be catering lunch.

We have several excellent speakers that will provide very valuable insight into several important decisions that we will have to make during 2024. We look forward to seeing you there!

Demonstrating Environmental Stewardship

Dear Tennessee Producer:

We invite you to participate in a study conducted by University of Tennessee Institute of Agriculture researchers along with the Tennessee Department of Agriculture. The purpose of this survey is to demonstrate the progress Tennessee farmers are making towards environmental stewardship.

The survey should take about 10 minutes to complete. Your participation is voluntary. NO personal information or data is collected.

Click the link below to begin the survey:

https://utk.co1.qualtrics.com/jfe/form/SV_dhwdnXtVzUMeEg6

Please contact us if you have any other questions about the survey. Thank you for taking time out of your busy schedule to help us!

Thank you for your time,

Dr. Chris Boyer (cboyer3@utk.edu)

Dr. Aaron Smith (aaron.smith@utk.edu)

Dr. Forbes Walker (frwalker@utk.edu)

UT Institute of Agriculture, The University of Tennessee Knoxville

John McClurkan (john.mcclurkan@TN.gov)

Tennessee Department of Agriculture

2023 Tennessee Cotton Variety Trial Results now available

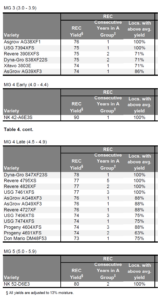

The 2023 Tennessee Cotton Variety Trial Results (PB 1742) are now available online. Included within these results are thirteen large strip trials (CSTs) testing 13 XtendFlex commercial varieties, four large strip trials (CSTs) testing 6 Enlist commercial varieties, and eight small plot trials (OVTs) testing 44 experimental and commercial varieties.

Special thanks to all of the agents and producers who helped generate this data. Additionally, thanks to the USDA Classing Office in Memphis for assisting with this effort. If you have any questions on location response or variety placement, please do not hesitate to reach out directly to your county agent.

Final TN Corn Hybrid Tests in TN Report Available

The final version of the TN Corn Grain Hybrid Tests in TN publication is available as a pdf and excel files on search.utcrops.com. This report includes both the OVT and CST data.

2023 Soybean OVT Prelim

Prelim results from the 2023 TN soybean OVT are now available as pdf (2023 Soybean Tables, 2023 Soybean Tables Appendix) and excel files (2023 Soybean Tables, 2023 Soybean Tables Appendix). Seventy-one varieties were evaluated in small plot replicated trials (REC) at 8 sites. In addition to yield, moisture, lodging, maturity, oil, and protein, data were collected on diseases, including frogeye and SDS, at locations where these diseases were present. The final CST data and disease trials are not in the prelim report but will be included in the final version to be posted here and on search.utcrops.com. Varieties that were in the A group in the OVT are listed below.