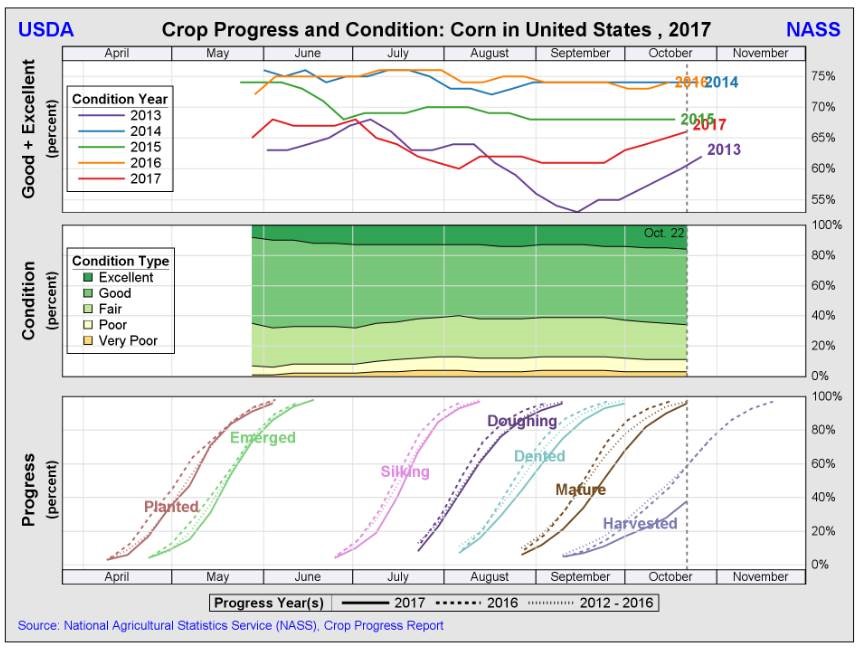

Corn: For the week, corn futures traded $0.05 higher. Corn futures have traded mostly sideways since we have entered into harvest season. Corn prices continue to receive bearish news in the form of larger ending stocks and a stronger dollar. Large global supplies will be a hindrance to higher corn prices for the foreseeable future. Unfortunately, a higher dollar is making U.S. corn less competitive in the export market. This week, the USDA rated the corn crop as being 66% good-to-excellent with 38% of the crop already harvested.

The above chart shows the crop condition rating of the U.S. corn crop. We have had four back-to-back years of a good corn crop. In fact, the corn condition score has been higher than 65% good-to-excellent since 2014. This chart does not show the size of the planted corn crop, which is a very large factor in the size of the U.S. corn crop. However, it does demonstrate just how good the last few years have been on a national scale regarding the corn crop. The main point is that there are large corn supplies out there and the 2017 crop looks to only add to that number.

Locally, cash basis for corn averaged -$0.18 as of market close today.

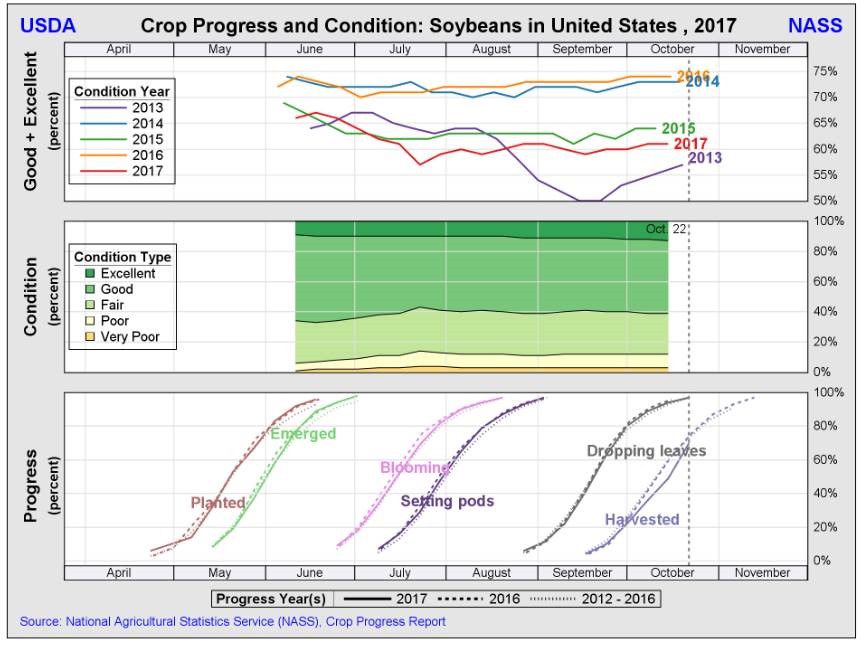

Soybeans: November soybean futures declined by $0.02 this week. Soybean harvest has picked up speed and basis levels are starting to reflect that fact. In West Tennessee, we are not seeing the sharp decline in basis as we saw at the end of September and early October. However, other parts of the U.S. are experiencing lower basis at river facilities. Some analysts are reporting that basis has dropped by as much as $0.25 per bushel in some areas over the past week.

The above chart shows the condition of the U.S. soybean crop. So far, the crop conditions for 2017 are on the lower end of the 5-year average. With that in mind, we still have planted the largest soybean crop on record. The USDA also reported that 70% soybean crop has been harvested as of October 22, 2017. The export market will be key to any increase in soybean futures.

Locally, cash basis for soybeans averaged -$0.25 as of market close today.

Wheat: Over the course of the week, July wheat futures increased by $0.02. In West Tennessee, farmers have been juggling the harvest of their soybeans and planting their wheat crop. For the most part, the wheat crop is in the ground and the rains today may be a welcome sight, especially after a dry year like last year. Farmers with much a lot wheat acres will want to pay attention to any rally in wheat prices related to potential winter injury of the wheat crop in the Southern Plains. Since we export so much of our wheat crop, a stronger U.S. dollar will be a huge hurdle for wheat prices to overcome.

New crop basis for wheat averaged -$0.07 as of market close today.

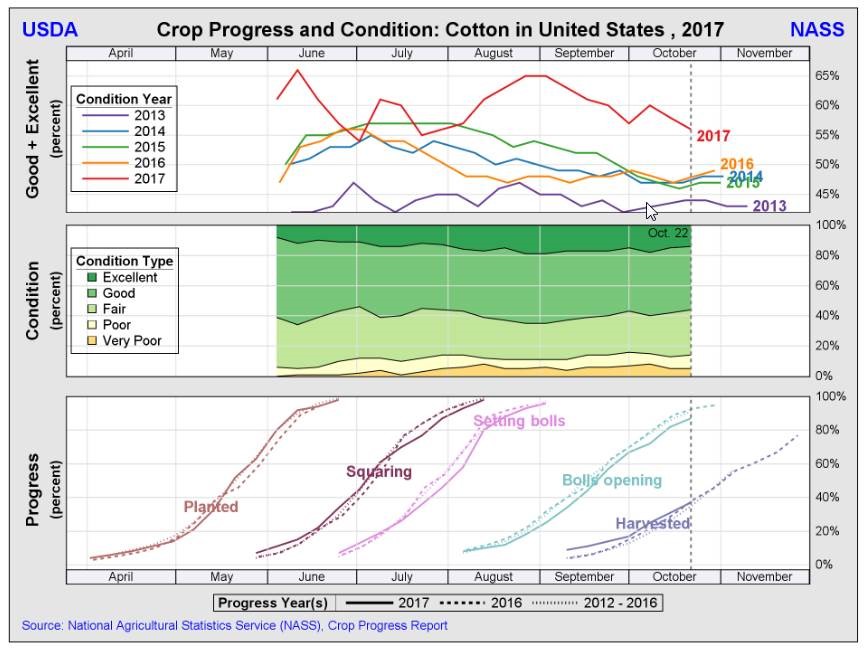

Cotton: December cotton futures closed at 68.22. Cotton equities continue to range between $0.13 and $0.14.

As you can see in the above chart, the U.S. cotton crop condition rating is much better than it has been in recent years. That combined with an increase in planted acres has the trade feeling that the cotton crop will be relatively large. However, only 37% of the crop has been harvested with only 31% of the Texas crop being harvested. The size of the total crop is still an unknown variable in the market price for cotton.

Take Home Message: Producers with unsold grain and/cotton will struggle to find selling points until the harvest window has closed. Until then, producers should explore opportunities that enable them to extend their marketing window. Farmers that have planted wheat will need to watch wheat prices and look for prices above the point of break-even.

Local Grain Elevator Bids: West Tennessee Grain Bids 10-27-2017